Contents

- 1 What is a binary option?

- 2 Binary Options vs. Traditional Options

- 3 Types of binary options

- 4 Advantages of binary options

- 5 Disadvantages of binary options

- 6 How to trade binary options

- 7 How to choose a broker

- 8 Regulation

- 9 CFDs vs Binary options

- 10 Forex vs Binary options

- 11 Are binary options a scam?

- 12 Are binary options gambling ?

Welcome to Binary-options.org, the definitive guide to binary options trading in 2025. As a trusted resource with years of experience in financial markets, we combine practical knowledge, regulatory expertise, and advanced trading strategies to empower traders at all levels. Whether you’re a beginner taking your first steps or an advanced trader refining your approach, this guide provides actionable insights, expert advice, and reliable tools to navigate the binary options market effectively and safely.

Our commitment is to ensure that traders have access to credible information, regulatory updates, and proven trading strategies, all backed by comprehensive analysis and a deep understanding of financial markets.

Main categories:

What is a binary option?

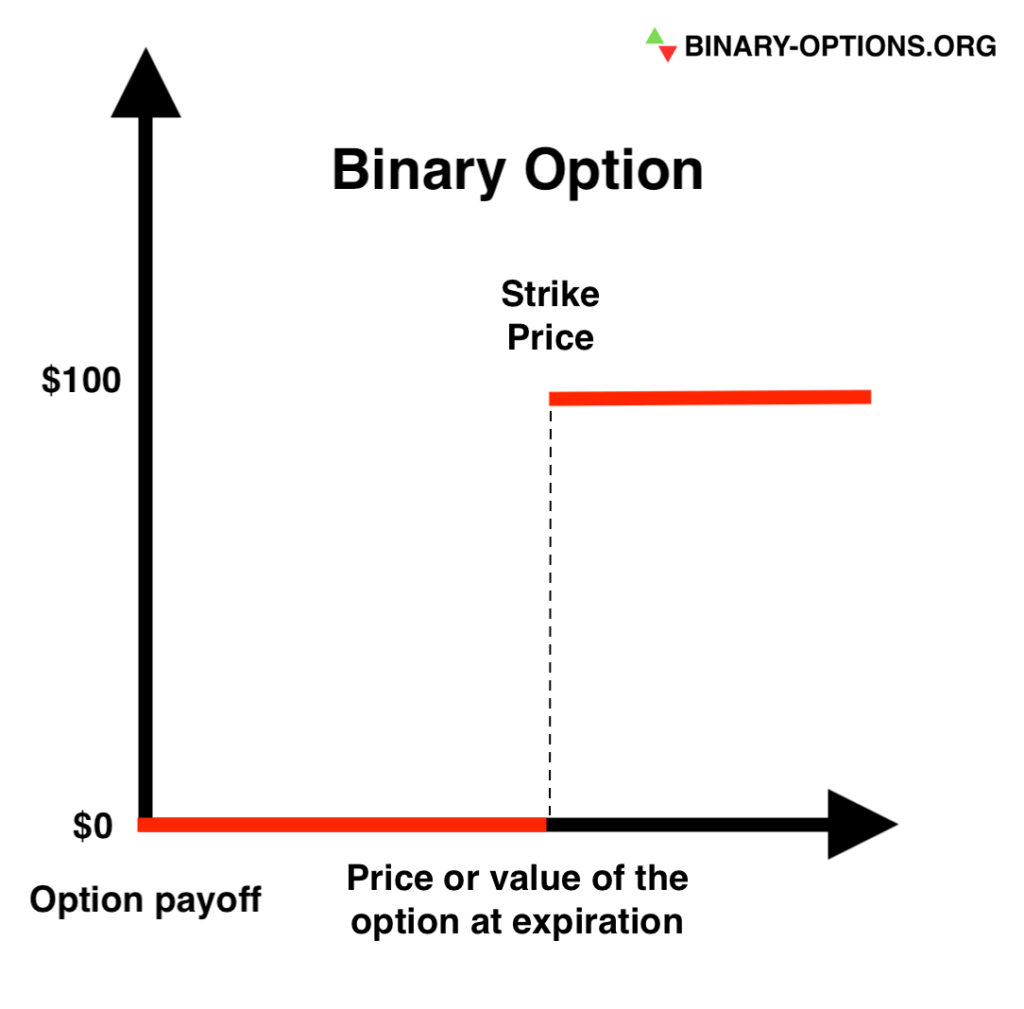

Binary options are financial derivatives that allow traders to speculate on the price movement of assets such as stocks, currencies, commodities, or indices. The “binary” nature reflects the two possible outcomes of each trade:

- “In the Money” (Successful Prediction): Receive a fixed payout (typically 70%-98% of your investment).

- “Out of the Money” (Unsuccessful Prediction): Lose the amount invested.

Unique Benefits:

- Defined Risk: Unlike traditional trading, losses are limited to the initial investment, and rewards are predetermined.

- Accessibility: Binary options platforms are user-friendly and designed for traders at all experience levels.

However, binary options carry significant risks due to their all-or-nothing nature. Traders should fully understand the mechanics and risks before participating.

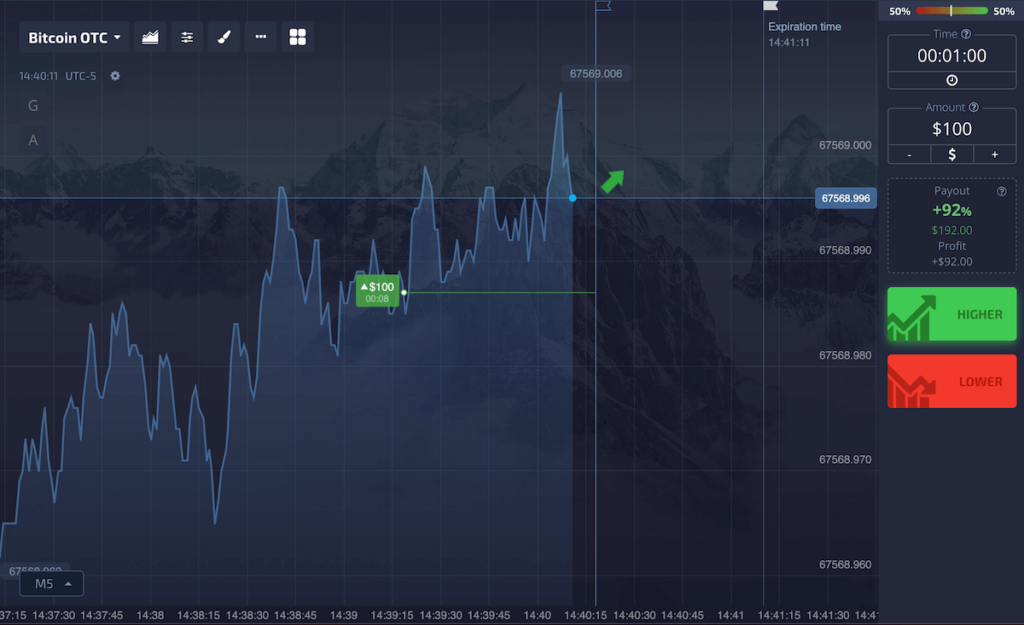

How Binary Options Work

Binary options are time-sensitive contracts where traders predict if an asset’s price will rise or fall compared to a predefined level (strike price) by a specific expiration time.

Key Components of a Binary Option Trade:

- Underlying Asset: The financial instrument being traded (e.g., EUR/USD currency pair or gold).

- Strike Price: The reference price at the trade’s start.

- Expiry Time: The trade’s duration (e.g., 1 minute, 1 hour, or 1 day).

- Payout Rate: The profit percentage offered for a successful trade.

Binary Options vs. Traditional Options

Binary options and traditional options allow speculation on price movements but differ significantly in mechanics and flexibility. Understanding the differences between binary options and traditional options is essential for making informed trading decisions. Here’s a table outlining the key differences between binary options and traditional options:

| Feature | Binary Options | Traditional Options |

|---|---|---|

| Outcome | Fixed profit or loss | Variable profit or loss |

| Complexity | Simple, predefined outcomes | Complex, requires strategic planning |

| Risk/Reward | Fixed risk and reward | Unlimited gains and losses |

| Time Horizon | Short-term focus | Short to long-term |

Binary options are best suited for traders who prefer simplicity, while traditional options provide greater flexibility for those with advanced knowledge and hedging needs.

Types of binary options

The types of binary options have a unique structure and risk level. Understanding the different types of contracts can help traders select the most suitable based on their market analysis and risk tolerance.

- Up/Down or High/Low: This is the simplest and most common type of binary option. Traders decide if the price of an asset will be higher or lower than its current price at the time of expiration. If they predict correctly, they win the trade.

- In/Out, Range or Boundary: This type involves two price levels, forming a range or boundary. Traders predict whether the price will end up within this range at expiration. It suits markets with stable prices and can offer higher returns if the range is accurately set according to market behavior.

- Touch/No Touch: These options have a set price level that the asset must either reach (Touch) or not reach (No Touch) before expiration. A ‘Touch’ option yields a payout if the asset price touches the set level even once before expiration, while a ‘No Touch’ option pays out if the price never reaches the level.

- Ladder Option: Ladder options involve several price levels that need to be achieved sequentially. Each rung of the ladder has a price to reach, and payouts can increase as the price moves further with each rung. This type is complex but can be highly profitable for advanced traders with strong market predictions.

Advantages of binary options

The advantages of binary options are significant, catering to both novice and experienced traders due to their straightforward nature and diverse market accessibility. Here are the key benefits:

- Simplicity: Binary options require only a basic decision-making process, focusing on whether the price of an asset will go up or down, without complex exit strategies.

- Defined Risk: Traders know in advance exactly how much they stand to gain or lose, making it easier to manage financial risk.

- Quick Results: With expiry times that can be as short as 60 seconds, binary options offer the potential for quick returns.

- Accessibility: Traders can access a wide range of markets and asset classes, including stocks, currencies, commodities, indices, and cryptocurrencies, all from a single platform.

- Low Entry Threshold: Many brokers offer low minimum deposit requirements and small trade sizes, making it accessible for beginners to start trading.

Disadvantages of binary options

The disadvantages of binary options are important to consider before engaging in this type of trading. Despite their apparent simplicity, these options come with certain risks and limitations:

- High Risk of Loss: The all-or-nothing nature of binary options means that while you can gain substantial profits, you can also lose your entire trade.

- Limited gains: Because traders know in advance exactly how much they stand to gain or lose, the gains per operation are also limited to the predefined payout.

- Limited Regulatory Oversight: In some regions, binary options markets are not heavily regulated, which can expose traders to potential fraud and scams.

- Over-Simplification: While the simplicity of binary options can be an advantage, it also means limited tools like leverage compared to other trading options.

- Potential for Addictive Behavior: The fast-paced nature of binary trading, especially with short expiry times, can lead to addictive behavior similar to gambling.

How to trade binary options

To trade binary options, follow my simple step-by-step guide below. Trading binary options involves a straightforward process that can be broken down into a series of steps. Here’s a comprehensive guide to help you trade binary options:

1. Choose a Broker

Your first step is to select reputable binary options brokers. Look for brokers that are regulated by recognized financial authorities, offer a user-friendly trading platform, and provide access to a wide range of assets. Reviews and comparison tools can be helpful in finding the best binary trading site that meets your needs.

2. Select the Asset or Market to Trade

Binary options brokers offer a variety of assets for trading, including stocks, commodities, currencies, and indices. Choose an asset or market that you are familiar with or that you have researched thoroughly.

3. Select the Expiry Time

The expiry time is the point at which a trade is closed and settled. It can range from short durations like 5 seconds or 60 seconds, up to longer periods such as hours, days, or even weeks. Your choice should be based on your analysis and trading strategy.

4. Set the Size of the Trade

Decide on how much money you want to risk on the trade. It’s important to manage your risk carefully, considering that 100% of the investment is at risk. Never invest more than you can afford to lose.

5. Choose Call/Put or Buy/Sell

Make your prediction:

- If you think the asset’s price will rise by the expiry time, you choose “Call” or “Buy” or “Higher”.

- If you believe the price will fall, select “Put” or “Sell” or “Lower”.

6. Check and Confirm the Trade

Most platforms will give you a chance to review the details of your trade and confirm your decision. Check the investment amount, the asset, the expiry time, and your prediction before confirming the trade.

7. Monitor Your Trade

After placing your trade, you can monitor its progress until the expiry time. Some platforms provide the option to close the trade before expiry, potentially allowing you to lock in profits or cut losses.

8. Wait for the Outcome

Once the expiry time is reached, the trade will close, and you will either receive the predetermined payout if your prediction was correct or lose your investment if it was not.

How to choose a broker

To choose a broker for binary option trading, it’s essential to carefully assess various factors that will impact your trading effectiveness and security. A good broker can enhance your trading experience and increase your chances of success. Here are several key criteria to consider when selecting a broker:

- Regulation: Ensure the broker is regulated by credible authorities. This step is crucial for your security and to avoid potential scams.

- Payouts: Look at the payout rates offered. Higher payouts are more favorable, but they should also be realistic and consistent with market standards.

- Minimum Deposit: Check the minimum deposit requirements. A lower minimum deposit is advantageous for beginners or those looking to test the platform without committing a large amount of capital.

- Asset Selection: A wide selection of assets allows greater flexibility in your trading strategies. Ensure the broker offers a range of assets that you are interested in and knowledgeable about.

- Trading Platform: The platform should be intuitive, reliable, and equipped with necessary trading tools. A good platform enhances your ability to make informed decisions quickly.

- Customer Support: Effective customer support is crucial, particularly for new traders. The broker should offer responsive and knowledgeable support.

Regulation

Binary option regulation ensures fair trading practices and protects traders from fraud. Regulated brokers are monitored by financial authorities that enforce strict guidelines and operational standards. Here are the major regulators in the binary options market:

- Cyprus Securities and Exchange Commission (CySEC): One of the first regulators to oversee binary options. It provides a regulatory framework within the EU.

- Financial Conduct Authority (FCA): The UK’s primary financial regulator, known for its strict standards and consumer protection.

- Commodity Futures Trading Commission (CFTC): Regulates binary option trading in the USA, ensuring that only a limited number of exchanges offer binary options under strict guidelines.

- Australian Securities and Investments Commission (ASIC): Oversees financial services and markets in Australia, including binary options, ensuring investor protection and market integrity.

- Financial Services Board (FSB): Regulates the financial industry in South Africa, protecting traders in one of the largest markets for binary options in Africa.

In addition to the major regulatory bodies, binary options trading is also monitored by other regulators around the globe. For instance, the Malta Financial Services Authority (MFSA) and the Isle of Man Gambling Supervision Commission regulate binary options as a form of betting. In Asia, the Financial Services Agency (FSA) in Japan oversees binary options, ensuring strict compliance with financial standards. Additionally, there are regulators in more jurisdictions, such as the International Financial Services Commission (IFSC) in Belize and the Vanuatu Financial Services Commission (VFSC) among many others.

These regulators help ensure that traders have a safe trading environment by monitoring brokers and enforcing regulations aimed at preventing financial malpractices.

CFDs vs Binary options

| Feature | Binary Options | CFDs |

|---|---|---|

| Leverage | Not available | Available |

| Risk/Reward | Fixed risk and reward | Variable gains and losses |

| Complexity | Simpler, no margin required | Complex, margin trading involved |

CFD trading and binary options trading are both popular forms of financial trading but differ significantly in their mechanisms and risk exposure. CFD trading (Contracts for Difference) involves buying and selling currencies, commodities, and other assets with the aim of profiting from changes in price. Traders have the potential to profit from both rising and falling markets, using tools like leverage to increase potential returns, which also increases potential losses.

In contrast to CFD trading, binary options trading simplifies the trading process significantly. Traders speculate on whether the price of an asset will be higher or lower than the current price at a predetermined future time, receiving a fixed payout if their prediction is correct.

Unlike CFD trading, binary options do not involve magnitudes of price movement; instead, the payout is binary, dependent solely on the direction of the price move relative to the strike price. This makes binary options simpler but limits traders’ control over risk and reward compared to the more flexible and potentially unlimited outcomes in CFD trading.

Forex vs Binary options

Forex and binary options both involve currency trading but differ in execution and risk.

| Feature | Binary Options | Forex |

|---|---|---|

| Execution | Predict price direction | Trade based on price fluctuations |

| Leverage | Not available | Widely available |

| Risk/Reward | Fixed | Variable |

Forex trading involves exchanging one currency for another with the aim of making a profit from changes in the exchange rate. This market operates 24/5, offering high liquidity and the ability to profit in both rising and falling markets through buying (going long) or selling (going short).

Forex traders can adjust their position sizes and use leverage to enhance potential returns, though this increases risk.

In forex trading, the potential gain or loss depends on the magnitude of the price movement between the entry and exit points. Traders buy or sell a currency at the current market price (entry) and aim to close the position at a more favorable price (exit), making a profit from the price differential.

The extent of the price change directly impacts the amount of profit or loss; the larger the change in price from the entry to the exit, the greater the potential financial outcome.

Binary options, on the other hand, are contracts that provide a fixed risk and reward. Traders choose whether the price of an asset, including forex currencies, will be higher or lower than the current price after a set period of time. If they predict correctly, they earn a predetermined payout; if not, they lose the amount they invested.

Thus, while binary options can be used to speculate on forex currencies, they differ significantly in terms of trading mechanics, potential gains, and risks. This distinction makes binary options a straightforward alternative to the complexities of traditional forex trading.

Are binary options a scam?

No, binary options are not a scam, but a high-risk, high-reward financial derivative. However, the industry has been marred by cases of fraud and deceptive practices by unscrupulous brokers. This has led to a negative perception among the public.

Binary options offer legitimate trading opportunities, but they require careful strategy and risk management due to their all-or-nothing nature. Traders should approach binary options with the same level of caution and diligence as they would with any other financial investment.

Are binary options gambling ?

Binary options are often compared to gambling due to their all-or-nothing outcomes, but they are not inherently gambling. These financial instruments allow traders to speculate on the direction of an asset’s price within a predefined period, which requires a certain level of market analysis and strategic planning, distinguishing it from pure chance.

However, the simplicity of the decision-making process — essentially predicting whether the asset price will go up or down — can mislead some into treating it like a bet rather than a financial strategy.

The key difference lies in the trader’s approach: if one relies solely on luck without any research or analysis, trading binary options becomes akin to gambling. Conversely, employing thorough analysis and disciplined trading strategies places it firmly within the realm of legitimate financial trading.